Karish

- Home

- Operations

- Israel

- Karish

Karish is a significant natural gas and liquids producing field offshore Israel. As per year end 2022, it contains 1,4 tcf gas 2P reserves plus 54 mmbls liquids 2P reserves. This represents a total of 307 mmboe 2P reserves.

Karish produces natural gas and hydrocarbons liquids through Energean’s regionally unique Energean Power FPSO. Located offshore Northern Israel, it is a major contributor to both energy competition and energy security in Israel.

Production commenced in 2022. Through 2023, gas production capacity reached an equivalent of 6.5bcm per year. Total production of gas and fluids was 87k boepd. This will be increased through 2024 as the FPSO is optimised. The Karish field is therefore and will remain a significant supplier to the Israeli gas market.

Natural gas produced from Karish is primarily sold to the Israeli power generation sector on long term “take or pay” contracts, providing security of supply and demand for all parties. Approx 20% is sold to industrial users. Hydrocarbon fluids are sold on international markets.

The field

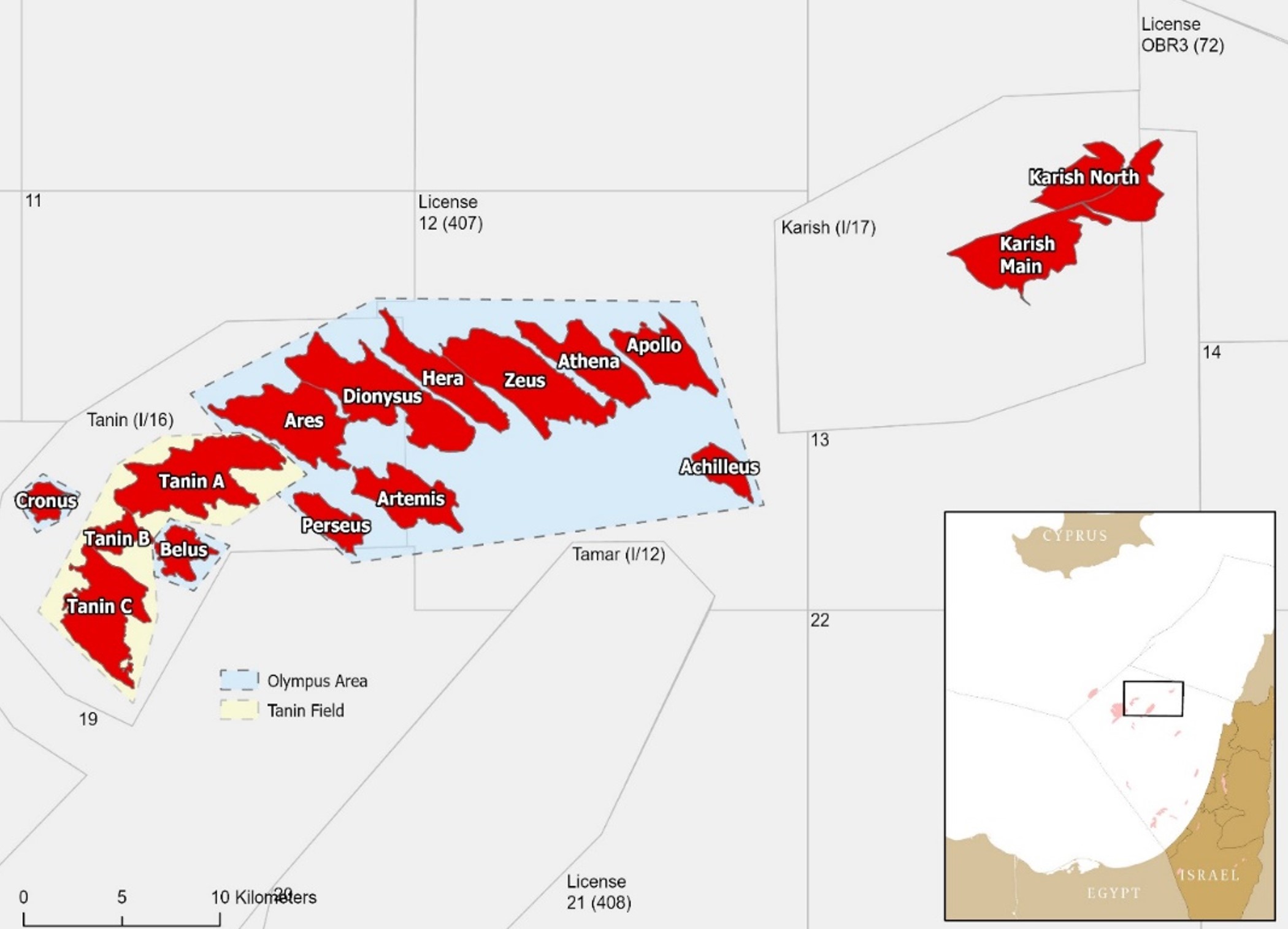

The Karish and Tanin fields, approximately 40 km apart, are located in the north of Israel’s exclusive economic zone (EEZ).

Both fields are part of the prolific Early Miocene Tamar Sands play. The fields are located north of the Tamar field, in water depths exceeding 1,700 metres.

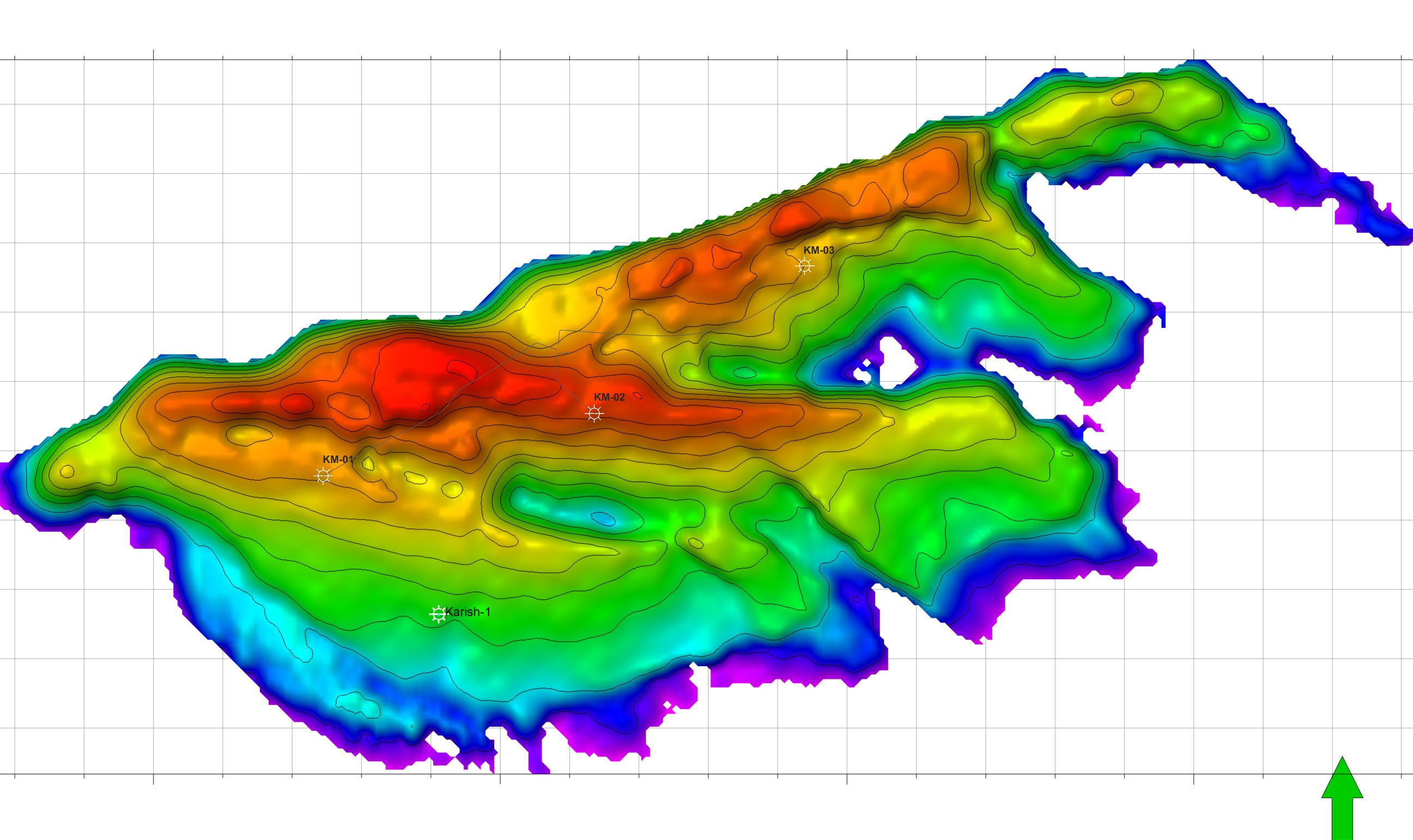

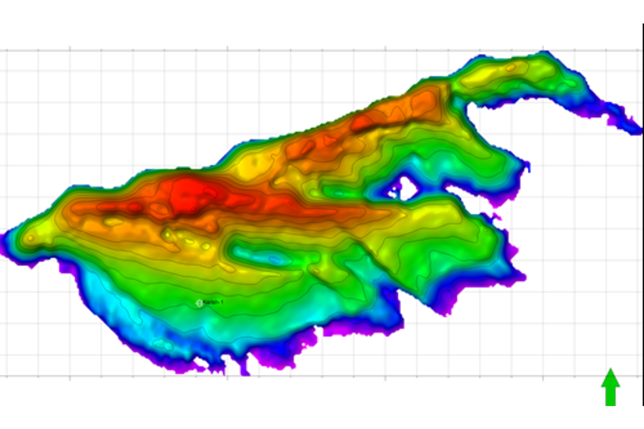

The Karish main field, located within the Karish lease, was discovered in 2013 and is located 25km northeast of the currently-producing Tamar field. The Karish main field is approximately 16km2 with a maximum estimated hydrocarbon column of 300 to 400m.

The Levantine Basin, in which the Karish and Tanin assets are located, contains up to 10,000m of Mesozoic and Cenozoic rocks above a rifted Triassic-Lower Jurassic terrain. The northern boundary of the Levantine Basin is defined by Cyprus and the Larnaca Thrust Zone, and its northwestern margin by the Eratosthenes Seamount. The Nile Delta Cone and the East Mediterranean coast define its southwestern and eastern margins.

The pressure volume-temperature models carried out in Karish demonstrate normal temperature and pressure for the depth of the reservoir. The field has strong vertical and lateral connectivity with faulting not expected to compartmentalise and a single gas-water contact has been evidenced by the seismic available for the Karish main field.

The Karish asset itself is a large two-way closure that sits on the southern upthrow side of a large down-to-the-north fault and is defined by 3D seismic data (2009 and 2010 Noble surveys). The Karish main field was evaluated by Noble in 2013 using a single discovery well (“Karish-1”) which was drilled by Noble to a depth of approximately 4,800m (true vertical depth subsea (“TVDSS”)). The discovered hydrocarbons within the Karish and Tanin Leases are contained with the Early Miocene submarine fan deposits of the Tamar Sands. Seismic data further suggests continuity of the main Miocene sands between the Leviathan, Tanin and Karish fields.

The Tamar Sands are further subdivided into more detailed reservoir units (A-D Sands, with A being stratigraphically the youngest). The C Sands at Karish are approximately 130m TST and are interpreted to be extensive across the entire structure. The fluid in the Karish C reservoir is substantially richer than that discovered in the other Levantine basin fields such as Tanin, Tamar and Leviathan. The B sands at Karish, while thinly bedded, can be identified on the available image logs.

The reservoir at Karish is well defined and well understood as it is analogous to the reservoir sands at Tamar and Leviathan and the 3D seismic data available is of excellent quality.

Within the Karish field a seismic amplitude anomaly associated with the C sands has been identified. This anomaly was tested by Karish-1, and other similar anomalies have been observed in the Karish North Upthrown prospect and the Karish Northeast prospect.

DeGolyer & Mac Naughton CPR (November 2020) certified additional 8,1 bcm of gas plus 22,3 mmbls light hydrocarbon liquids un-risked resources (70% net to Energean).

History

In August 2016, Energean acquired the Karish and Tanin fields from Delek Drilling and Avner. Four months later the company was granted approval by the Israeli Government to transfer the two leases to Energean Israel, the Group’s subsidiary. These licenses expire in 2044, with a 10-year extension option.

In December 2016, Energean's subsidiary, Energean Israel, with the financial backing of its partner Kerogen Capital, received from the Israeli Government the approval for the Field Development Plan (FDP) to develop the Karish and Tanin fields via a gas FPSO.

In August 2017, Energean Israel received from the Israeli Government the approval of the FDP for both fields.

Both fields were discovered by Noble in the Levantine Basin in 2011 and 2013.

Karish-1 was spudded on 21 March 2013 and reached a total depth of 4,812 metres The drilling (true vertical depth subsea (“TVDSS”)) lasted 77 days and discovered a gross gas column of 135 metres with 72 metres of net pay over three Tamar A-B-C Sands (90 per cent of net pay in C-Sand).

30-year leases (with a 20-year option extension) were granted in November 2014 covering the fields plus adjacent exploration targets, without gas export rights.

The Israeli Market

The gas produced both from the Karish and Tanin reservoirs is intended to supply the rapidly growing domestic Israeli market.

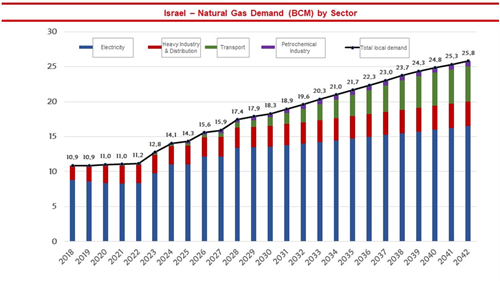

Israel is one of the world's most rapidly growing natural gas market as gas demand increased by an average 15,5% from 2006 to 2016. Consumption increased further to 10.3 BCM in 2017 and 10.9 BCM in 2018. According to the Adiri Committeee report consumption will reach 14.3 BCM in 2025 and 25.8 in 2042. Total 2018-2042 local consumption is estimated 452 BCM.

The main driver for this growth is expected to be an increased demand for electricity in Israel due to population growth, an increasing standard of living, greater use of water desalination, the electrification of the railway system, increased use of air conditioning, the adoption of electric vehicles and the increased use of CNG for transportation.

GAS SALES AND PURCHASES AGREEMENTS SIGNED

Energean has so far signed the following Gas Sales and Purchases Agreements (GSPAs):

-Dalia Power Energies, Or Power Energies, signed May 2017

-Dorad Energy, signed October 2017

-Edeltech (Ramad Negev Energy, Ashdod Energy), signed October 2017

-Israel Chemicals, signed December 2017

-Bazan Oil Refineries, signed December 2017

-OPC (independent power producer), signed December 2017

-Rapac Group (telecom, government, energy and infrastructure), signed December 2017

-IPM Beer Tuvia (independent power producer), signed December 2018

-MRC Alon Tavor (independent power producer), signed November 2019

-Private company in Israel, signed January 2020

-Ramat Hovav Power Plant, signed September 2020

-Rapac Group (telecom, government, energy and infrastructure), signed December 2020

Total firm GSPAs signed: 7.4 BCMA