Tanin

- Home

- Operations

- Israel

- Tanin

As per a Competent Persons Report (“CPR”) by DeGolyer and MacNaughton (“D&M” ). the Tanin Field contains 921 bcf gas 2P reserves plus 4.5 mmbls liquids 2P reserves. This represents a total of 171.7 mmboe 2P reserves.

The Group expects to develop the Tanin A, B and C blocks, following the development of Karish, Karish North and Katlan

The Field

The Tanin field is an undeveloped asset in the Levantine Basin and is located north of Israel’s EEZ approximately 110km offshore Israel. The water depth is about 1,800m. Tanin is located approximately 40km from the Karish field.

Tanin forms a northern extension of the Leviathan field that is currently being developed by Noble, Delek and Ratio. The Tanin field was evaluated by Noble in 2011 using the discovery well “Tanin-1” which reached a total depth of 5,504m (TVDSS) in what is now referred to as the Tanin-A Block.

It discovered gas saturated Tamar A and B sands and proved up gas volumes in the connected Tanin B and Tanin C Blocks. Reservoir properties determined from log and side-wall core data indicate the sands are analogous to those discovered in the Tamar and Leviathan fields. The Tanin Lease contains, in addition to Blocks A, B and C, significant exploration potential (Blocks D, E and F in the Lease itself and other accumulations that may close outside the Lease area).

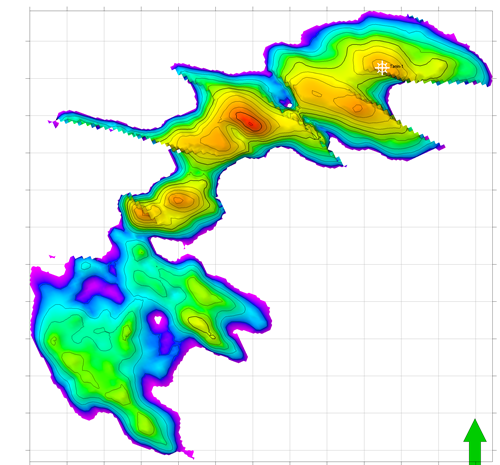

The field area is covered by the same 3D seismic data as the Karish field.

Within the Tanin Lease three additional structures at the Lower Miocene level have been identified from available 3D seismic data. Blocks A, B and C are interpreted to share a common gas water contact at between 5,070 and 5,095m (TVDSS).

The Tanin reservoir is shown in the Tanin-1 well to have similar good quality reservoir sands to those of the adjacent Tamar field (to the south) and Karish field (to the east), with high average porosity of approximately 22% and permeability of approximately 300mD. The reservoir pressure is approximately 610 bar and both temperature and pressure are normal for the reservoir’s depth. The Group has generated static and dynamic models to enable future development planning at Tanin.

DeColyer & MacNaughton CPR (November 2020) certified another 10.7 bcm of gas plus 2.3 mmbls of light hydrocarbon liquids prospective resources. Also, another 10.3 bcm of gas plus 2.2 mmbls of light hydrocarbon liquids prospective resources are shared with Energean's Block 12.

Development

Download the Karish and Tanin FDP

According to a CPR produced by NSAI (June 2019), the Tanin Field contains 143 mmboe 2P reserves.

The Group expects to develop the Tanin A, B and C blocks after the Karish and the Karish North field. The exact date will depend on a number of factors, particularly:

- the quantity of gas sale contracts secured by the Group by 2021 and the growth in gas sales subsequent to this date;

- the confirmed in-place volumes within the Karish field;

- the timing of exploration activities in and adjacent to the Leases and the results of these activities.

History

In August 2016, Energean acquired the Karish and Tanin fields from Delek Drilling and Avner. Four months later the company was granted approval by the Israeli Government to transfer the two leases to Energean Israel, the Group’s subsidiary. These licenses expire in 2044, with a 10-year extension option.

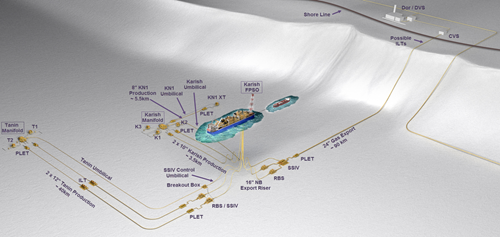

In December 2016, Energean's subsidiary, Energean Israel, with the financial backing of its partner Kerogen Capital, received from the Israeli Government the approval for the Field Development Plan (FDP) to develop the Karish and Tanin fields via a gas FPSO.

In August 2017, Energean Israel received from the Israeli Government the approval of the FDP for both fields.

Both fields were discovered by Noble in the Levantine Basin in 2011 and 2013.

Tanin-1 was spudded on 9 Dec 2011 and reached a total depth of 5,504 metres. It lasted 88 days and discovered a gross gas column of 31 metres with 24 metres of net pay in two Tamar (A and B) Sands (55 per cent of net pay in A-Sand).

30-year leases (with a 20-year option extension) were granted in November 2014 covering the fields plus adjacent exploration targets, without gas export rights.

The Israeli Market

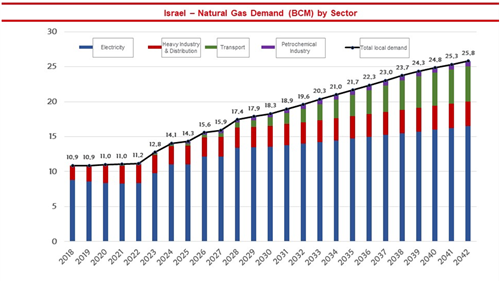

The gas produced both from the Karish and Tanin reservoirs is intended to supply the rapidly growing domestic Israeli market.

Israel is one of the world's most rapidly growing natural gas market as gas demand increased by an average 15,5% from 2006 to 2016. Consumption increased further to 10,3 BCM in 2017 and 10.9 BCM in 2018. According to the Adiri Committeee report, consumption will reach 14.3 BCM in 2025 and 25.8 in 2042. Total 2018-2042 consumption is estimated 452 BCM.

The main driver for this growth is expected to be an increased demand for electricity in Israel due to population growth, an increasing standard of living, greater use of water desalination, the electrification of the railway system, increased use of air conditioning, the adoption of electric vehicles and the increased use of CNG for transportation.